Where Can I Get 1099 Misc Forms for Free

1099-MISC Document Information

What is a 1099-MISC Form?

The 1099-MISC is used to study sure types of non-employee income. As of the 2022 tax year, the 1099-MISC is at present only used to report the following types of income worth at to the lowest degree $600:

- Rents

- Prizes and awards

- Other income payments

- Cash paid from a notional main contract made to an individual, partnership, or an manor

- Fishing boat proceeds

- Medical and wellness care payments

- Ingather insurance gain

- Gross gain paid to a lawyer

- Section 409A deferrals

- Nonqualified deferral compensation.

Additionally, use a a Form 1099-MISC for:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- To report that y'all made directly sales of at to the lowest degree $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

Bounty for freelancers and independent contractors are no longer reported using a 1099-MISC. Instead, they are reported using a 1099-NEC.

What you need to know

This document, technically known as the 1099-MISC Grade, is a taxation certificate that confuses. Who gets one? Who doesn't? Do I demand to transport them out? Many a bewildered business owner simply decides not to bother with it because they just don't know what to do. Fortunately, this form is relatively simple to understand and easy to fill out in one case you grasp the basics of completing the form and who needs to receive one.

The IRS provides specific and articulate instructions on when a 1099-MISC must be used. For example, if you received at least $600 in rental income, you lot would apply a 1099-MISC. If you paid a lawyer at least $600 for legal services of some kind for your business, y'all tin can send them a 1099-MISC. If y'all received a prize or an laurels worth at least $600 or if you lot give out a prize worth at least $600, a 1099-MISC is required/If you were paying an independent contractor or freelancer for at least $600 in services, you lot would utilise a 1099-NEC.

The individual or business receiving a 1099-MISC can use information technology in improver to or in place of the W-two that they would win in a standard employment system.

Equally previously mentioned, it is also used to report a prize or award from a business. Information technology reminds the recipient that they must pay taxes on that detail or income (if they haven't washed so already). It provides documentation that tells them exactly how much they've received from your business.

Don't delay or skip sending out the document by the end of January for the previous tax year. Declining to send it out every bit required can be punishable past fines of $30.00 to $100.00 per form.

If the IRS proves that a business intentionally disregarded the police force when they failed to send out the proper form, the punishment starts at $250.00 per missed statement and with no maximum.

In that location are quite a few exceptions for which you do not demand to send out a 1099-MISC (although this does not mean that the income is not taxable for the recipient). You're not required to transport i to existent estate agents or sellers of merchandise, storage, freight, etc. However, y'all are required to ship ane to whatsoever lawyer that y'all paid more than $600 to in a calendar year, even if they piece of work with a law firm.

What are the components of a 1099-MISC?

Overview of fields in a 1099-misc

Those who need to send out a 1099-MISC can acquire a costless fillable course by navigating the website of the IRS, which is located at www.irs.gov.

Once you've received your copy of the course, yous'll desire to familiarize yourself with the various boxes that must exist completed.

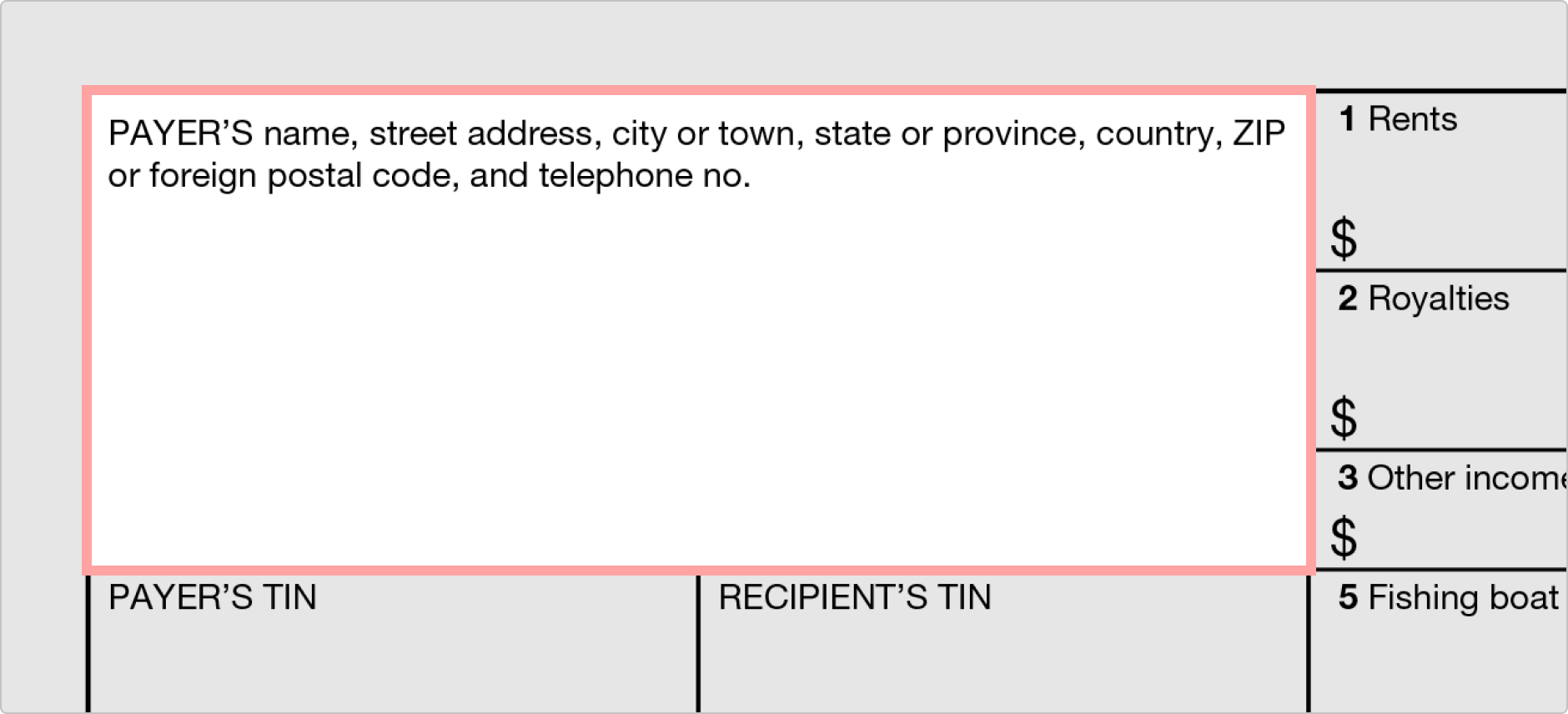

Nether the checkboxes that say "VOID" and "CORRECTED" (which are only to be used in exceptional circumstances), you'll find in the upper left corner a relatively large field for the payer's name and necessary contact data.

Payer's and Recipient'southward Data

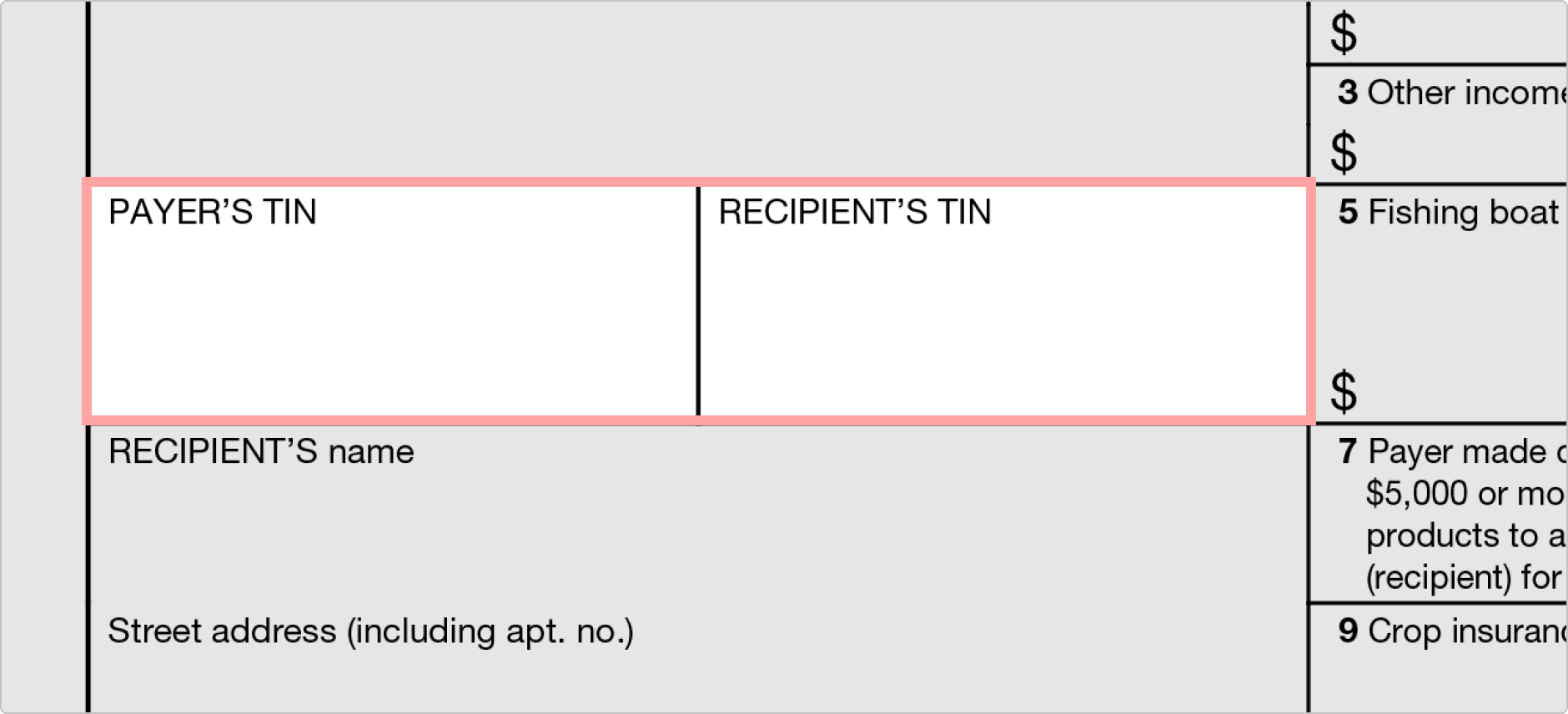

Under that large box volition be two smaller fields: one on the left for the payer's federal identification number (F-EIN) and 1 on the correct for the recipient's identification number (that'southward a fancy way of referring to their social security number, their taxpayer identification number (TIN), their adoption taxpayer identification number (ATIN), or their F-EIN. Ane thing to continue in mind is that a Box number doesn't designate this information as y'all'll find on the right side of the page and other tax render documents.

Interestingly, even though the contact information for the payer was simply one big box, the fields for the recipient's name, street address, city, country, and nix lawmaking are split. These separated fields are located under the boxes for the federal identification numbers of the payer and recipient of this IRS form.

Account Number

Adjacent, yous'll come across the account number field. It is located on the left side of the course, and it does non take its Box number. The account number is generally filled if the payer has multiple accounts for a recipient for whom they file more than ane 1099-MISC Form.

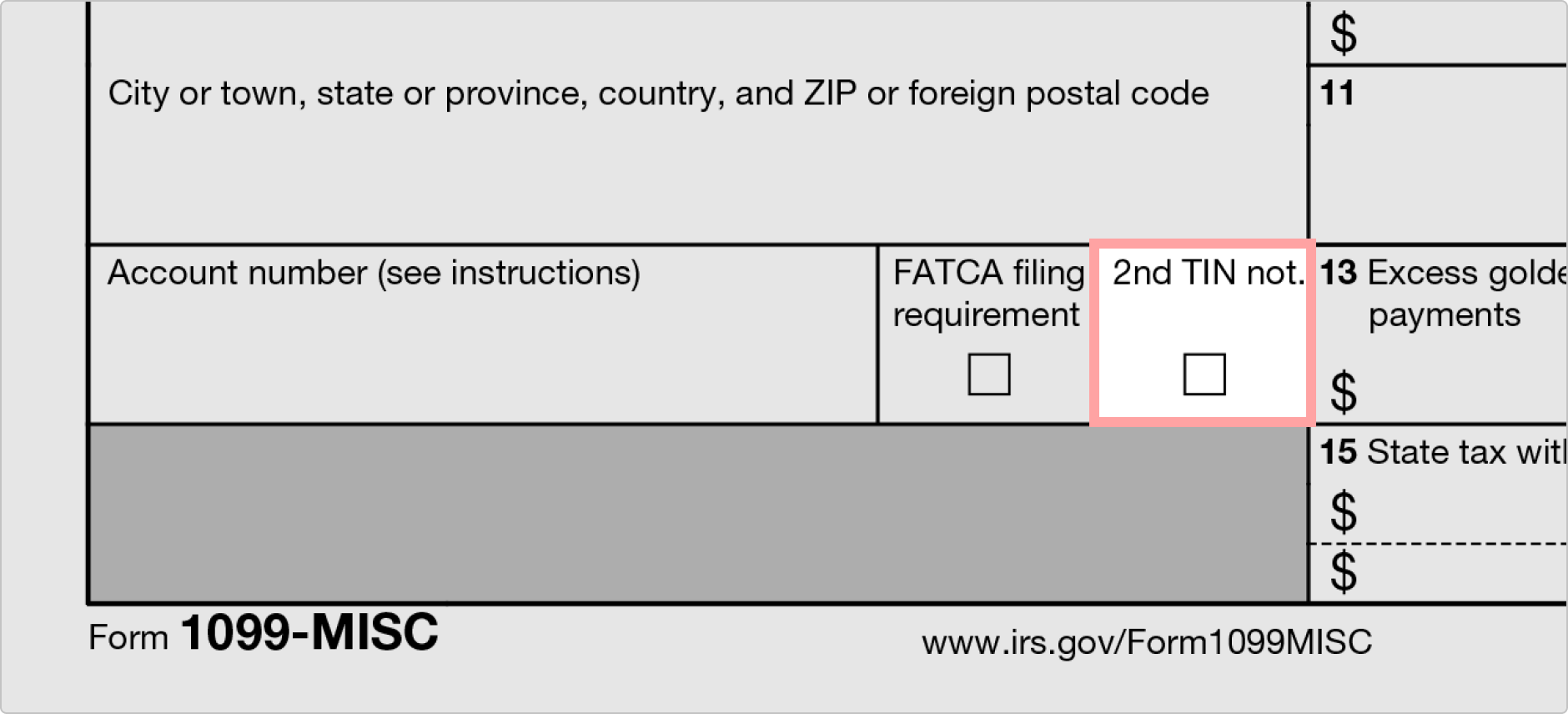

FATCA Filing Requirement Checkbox

You'll see a footling checkbox for FATCA Filing Requirement. This refers to the Foreign Account Revenue enhancement Compliance Human activity filing. You, as the payer, must exist a U.Southward. denizen required to study specified strange tax payments. This box has no identifying number. Information technology is located directly to the correct of the Business relationship Number Box.

2nd Tin No.

Next to the FATCA Filing Requirement checkbox, y'all'll see another checkbox for 2d TIN No. Check this box if you, every bit the payer, were notified twice by the IRS that the recipient'due south TIN was incorrect. This notification takes identify over three years.

Box ane

Box 1 is located on the correct side of the folio. It is designated as Rents. You would report rents from real estate listed on Schedule Eastward or Schedule C (depending on your circumstances). You lot can learn more nigh this box in the IRS instructions for the 1099-MISC Form.

Box ii

Box ii is designated as royalties for oil, gas, mineral properties, copyrights, and patents from Schedule Eastward. You'd besides use this box to report payments for working involvement. If you receive royalties on timber, coal, or atomic number 26 ore, you should consult IRS Pub. 527.

Box 3

Box 3 is used to report other income from Class 1040. Y'all'll too identify the type of payment. For case, if you lot won a prize worth $650, the corporeality would be reported in this box, and yous'd designate that as a prize. If the money is merchandise or business organization income, it is published on Schedule C or F, but will still be listed here.

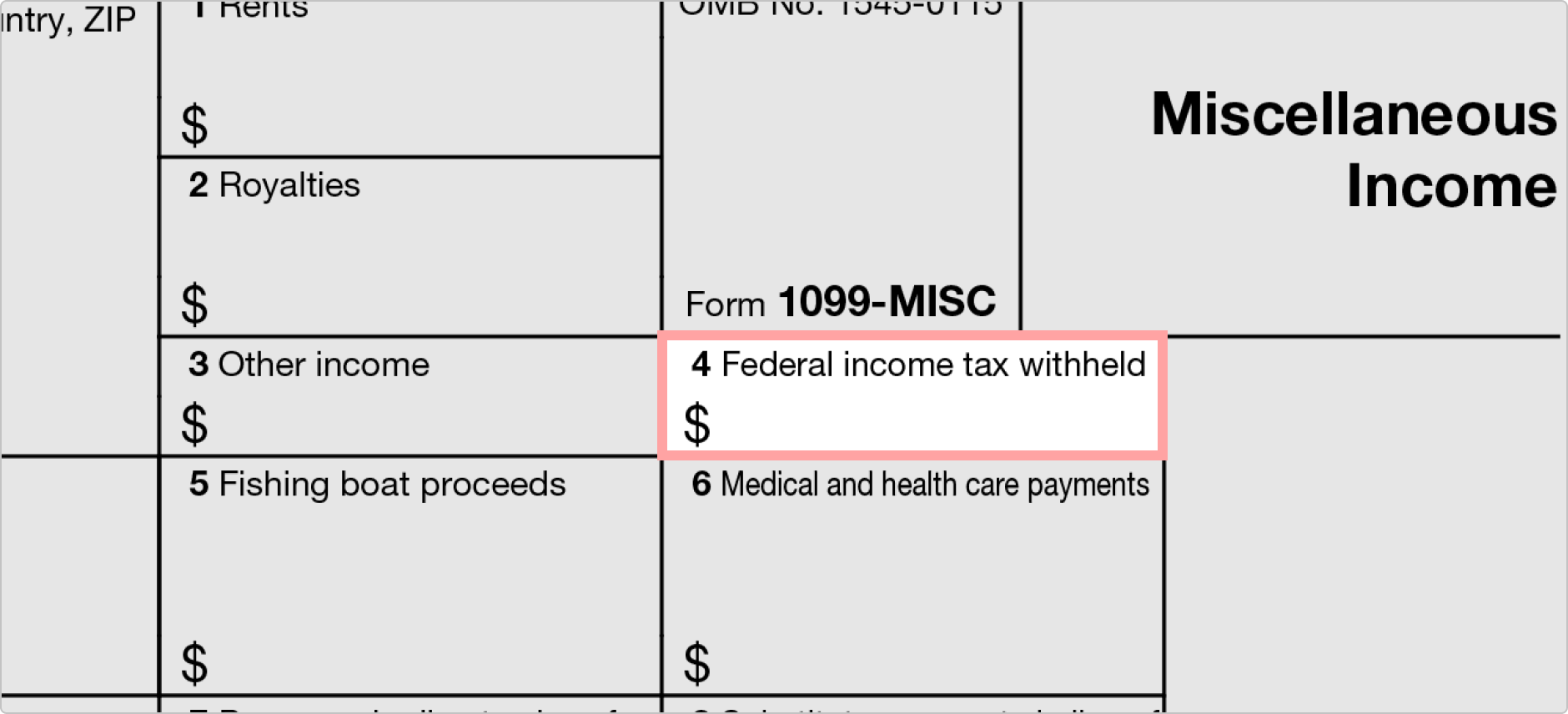

Box iv

Box 4 records backup withholding or withholding on Indian gaming profits.

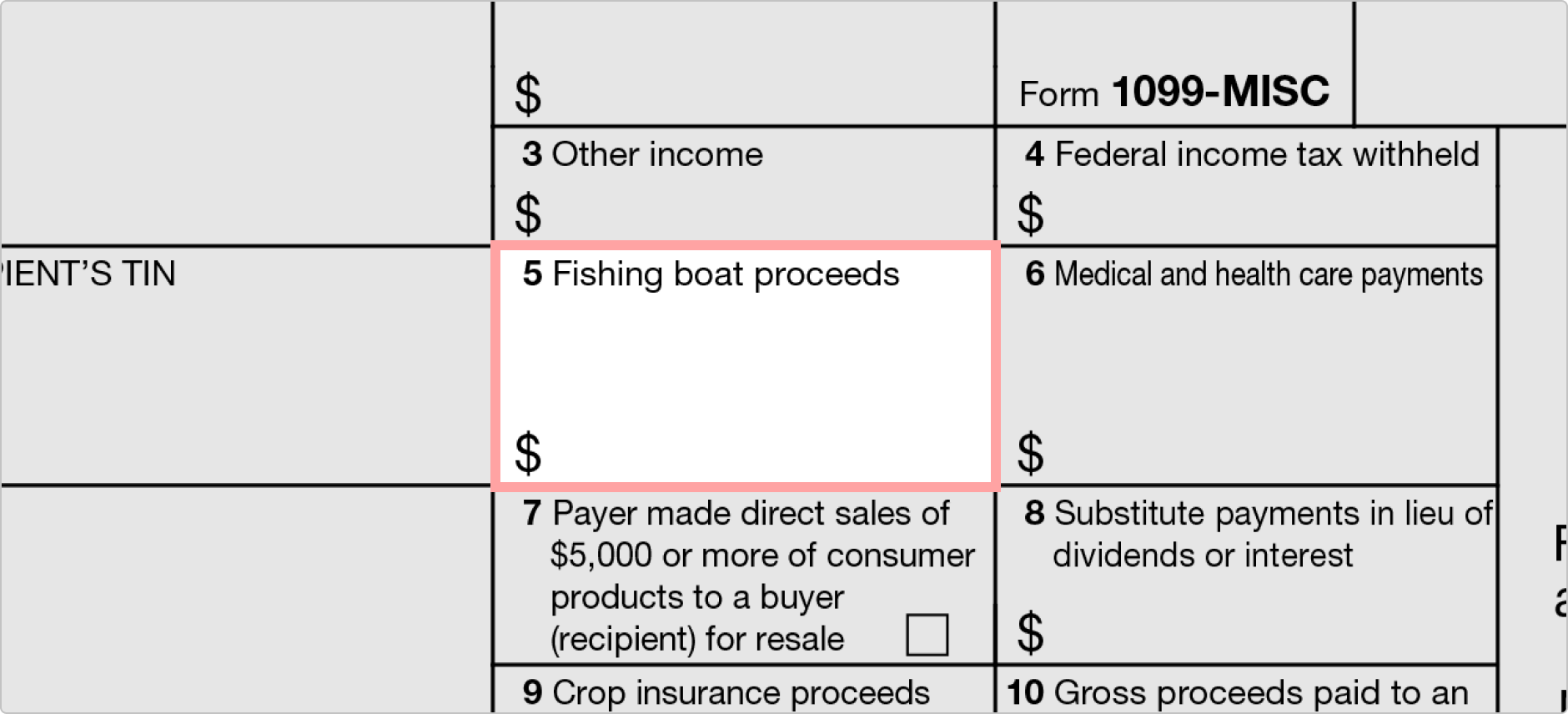

Box 5

Box 5 records money received by angling boat operators who are cocky-employed.

Box vi

Box 6 is for medical and health intendance payments that are reported on Schedule C.

Box vii

This box holds a checkbox that y'all will use if you made straight sales totaling $five,000 or more of consumer products to the recipient for resale. Call back that freelancers and independent contractors at present have their payments reported via 1099-NEC.

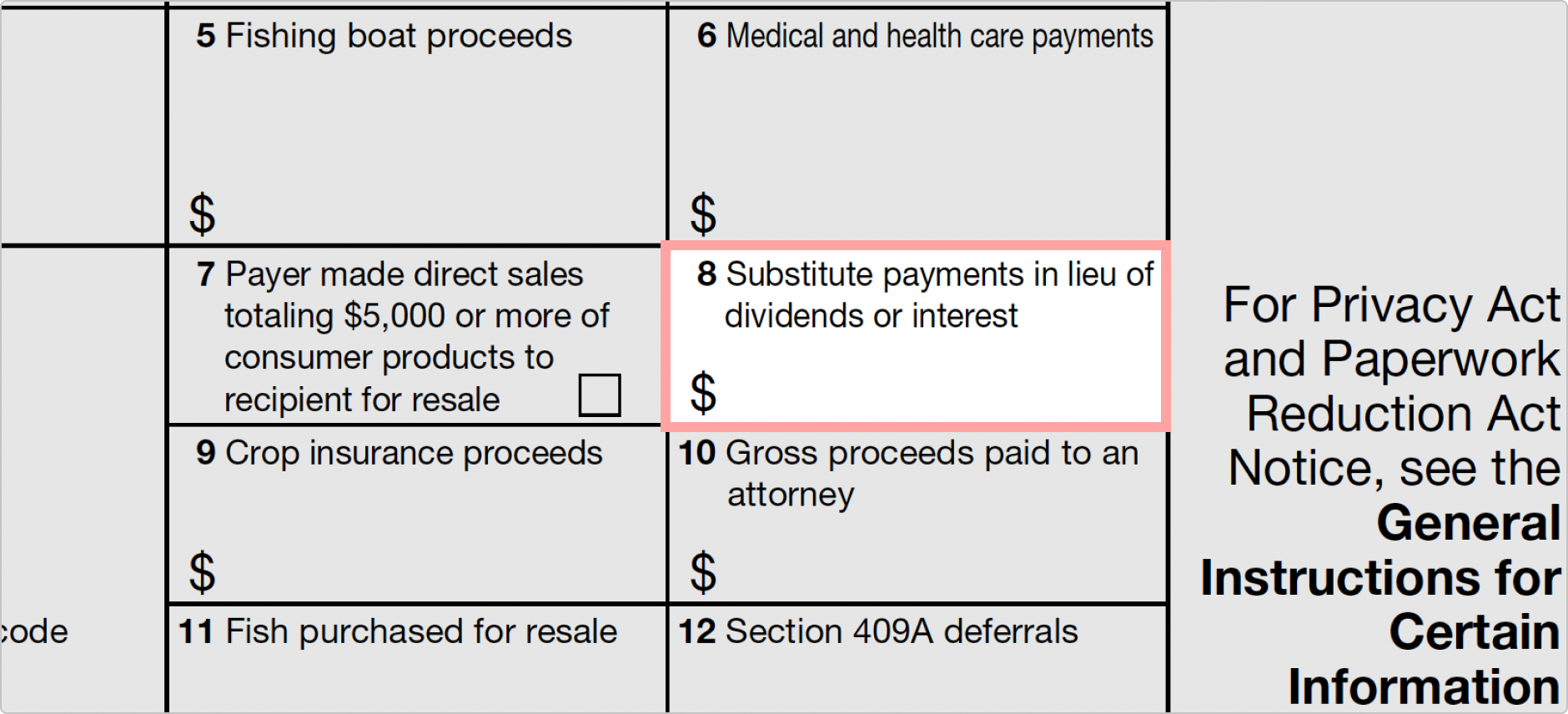

Box eight

This box records substitute payments instead of dividends or interest.

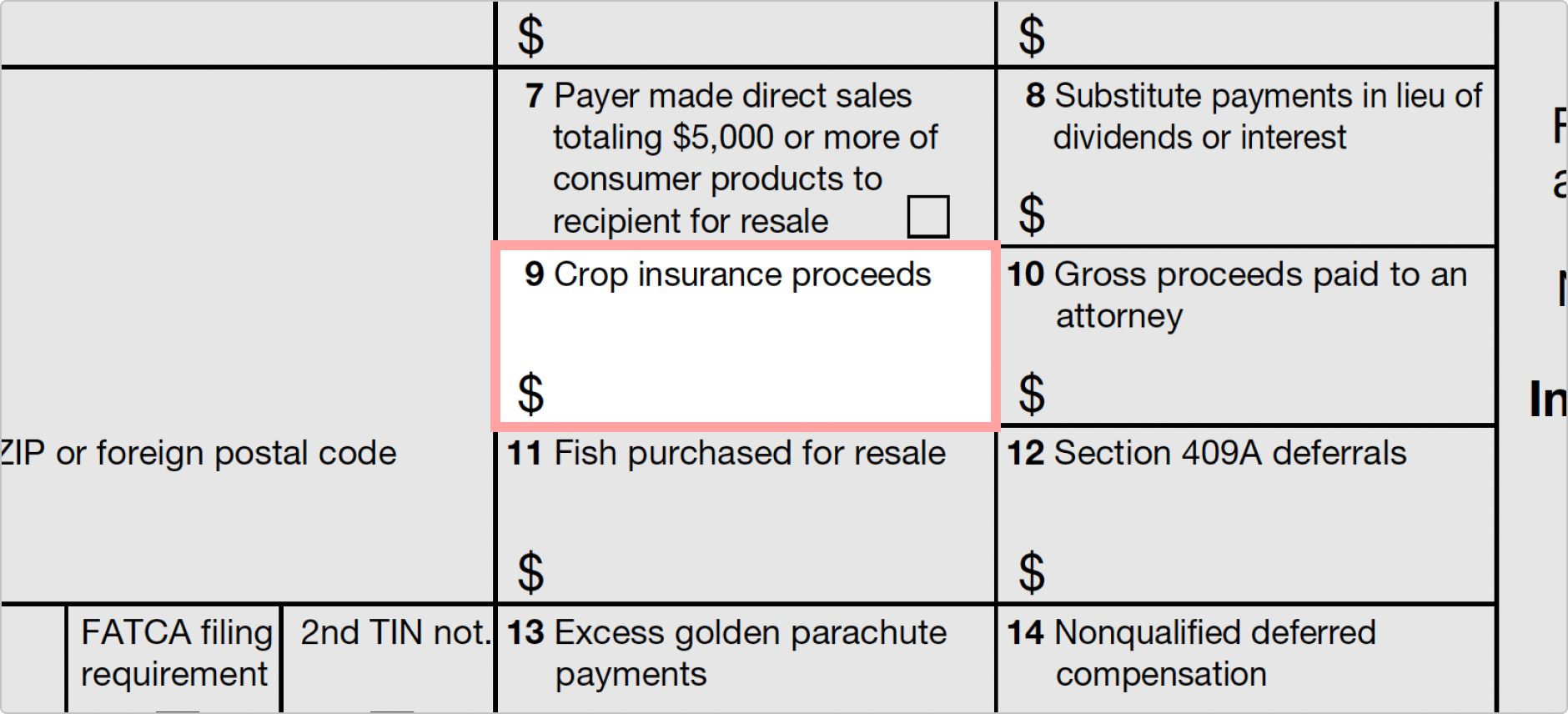

Box 9

Box ix records crop insurance gain.

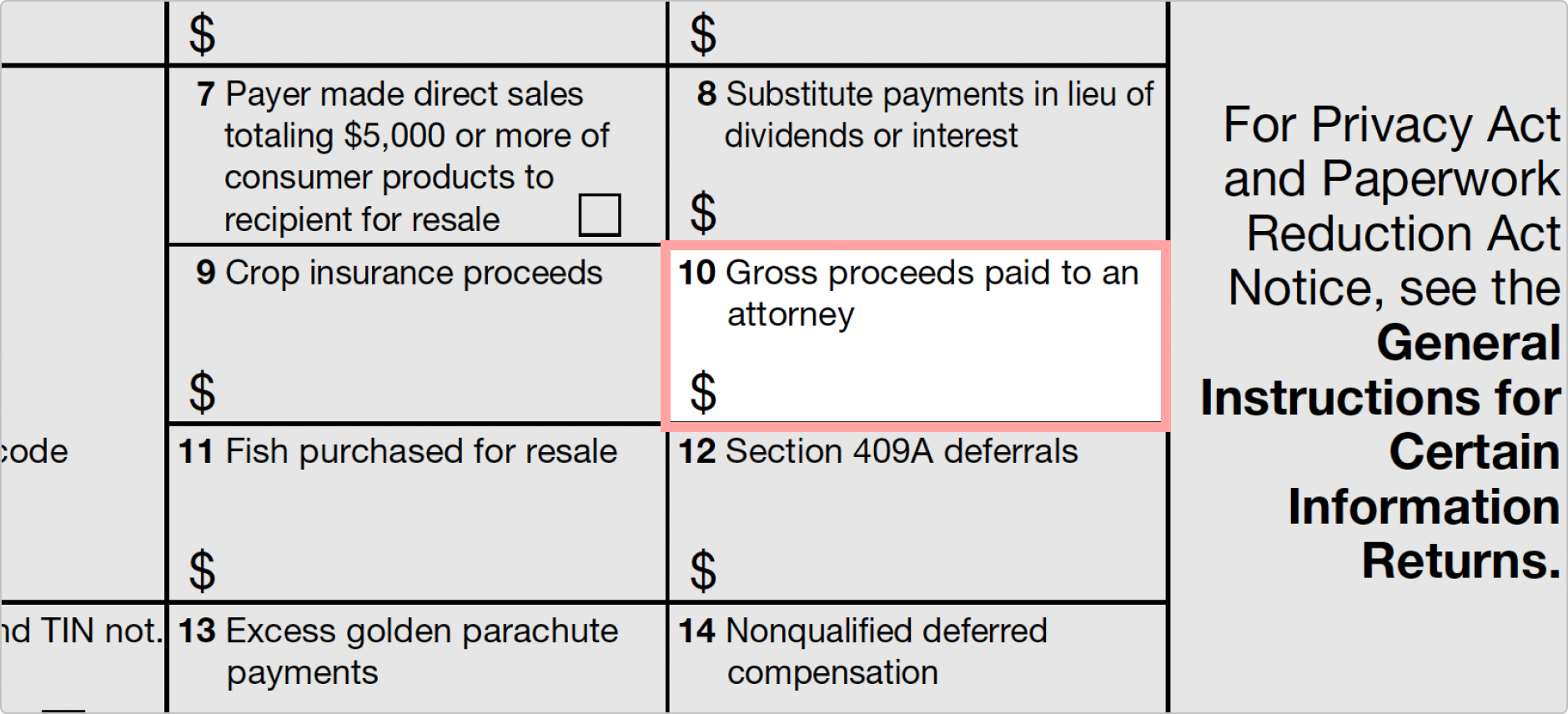

Box x

Box 10 records the gross gain paid to an attorney.

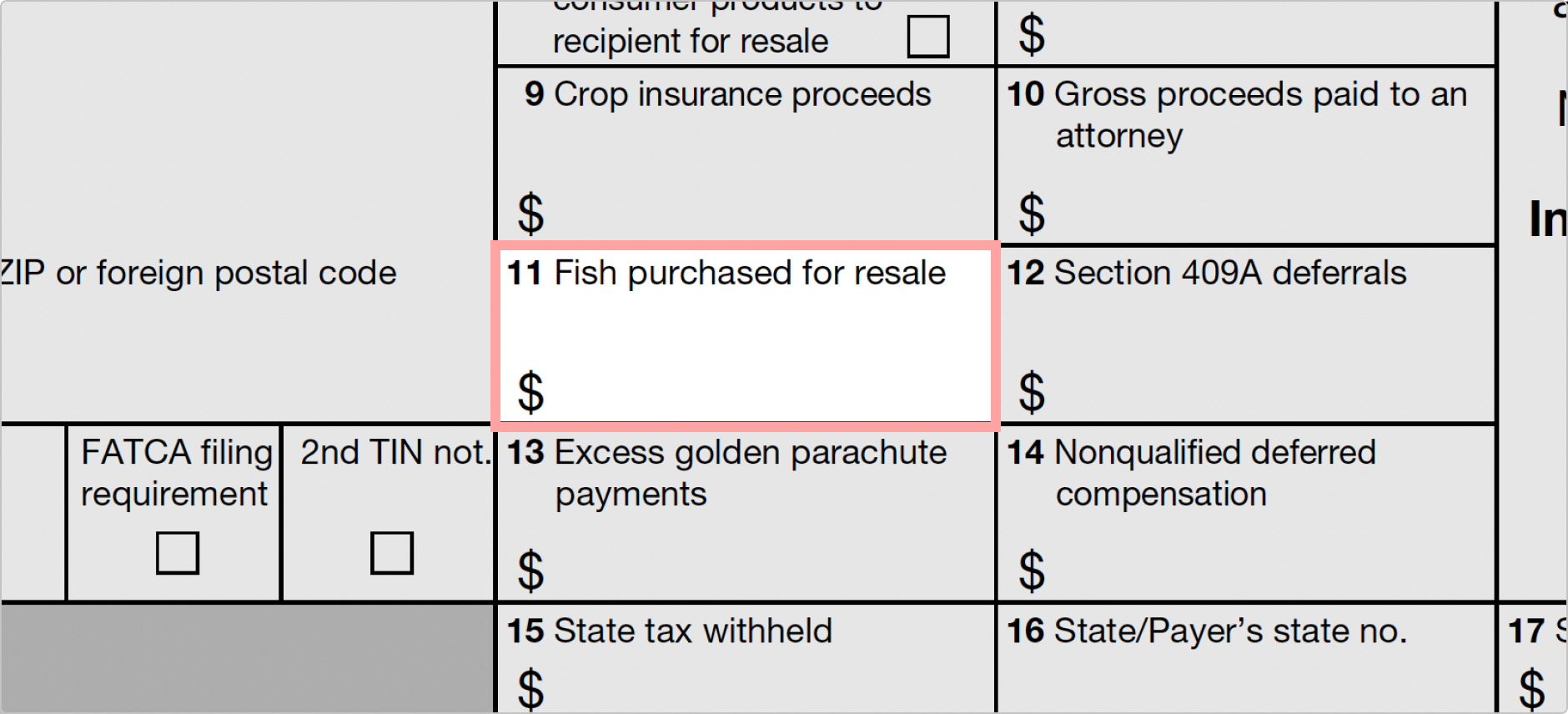

Box eleven

Box 11 records cash payments for the purchase of fish for resale.

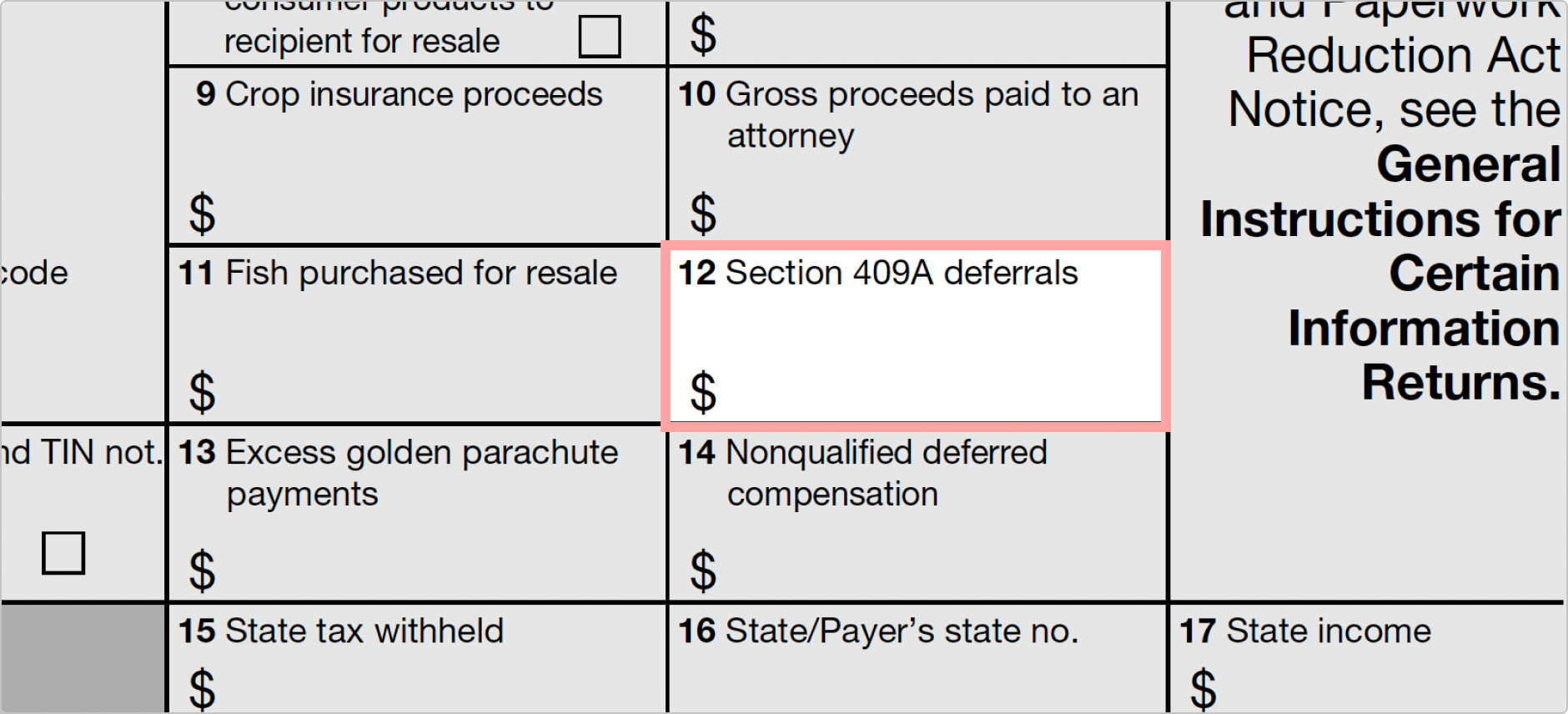

Box 12

Box 12 records Department 409A deferrals.

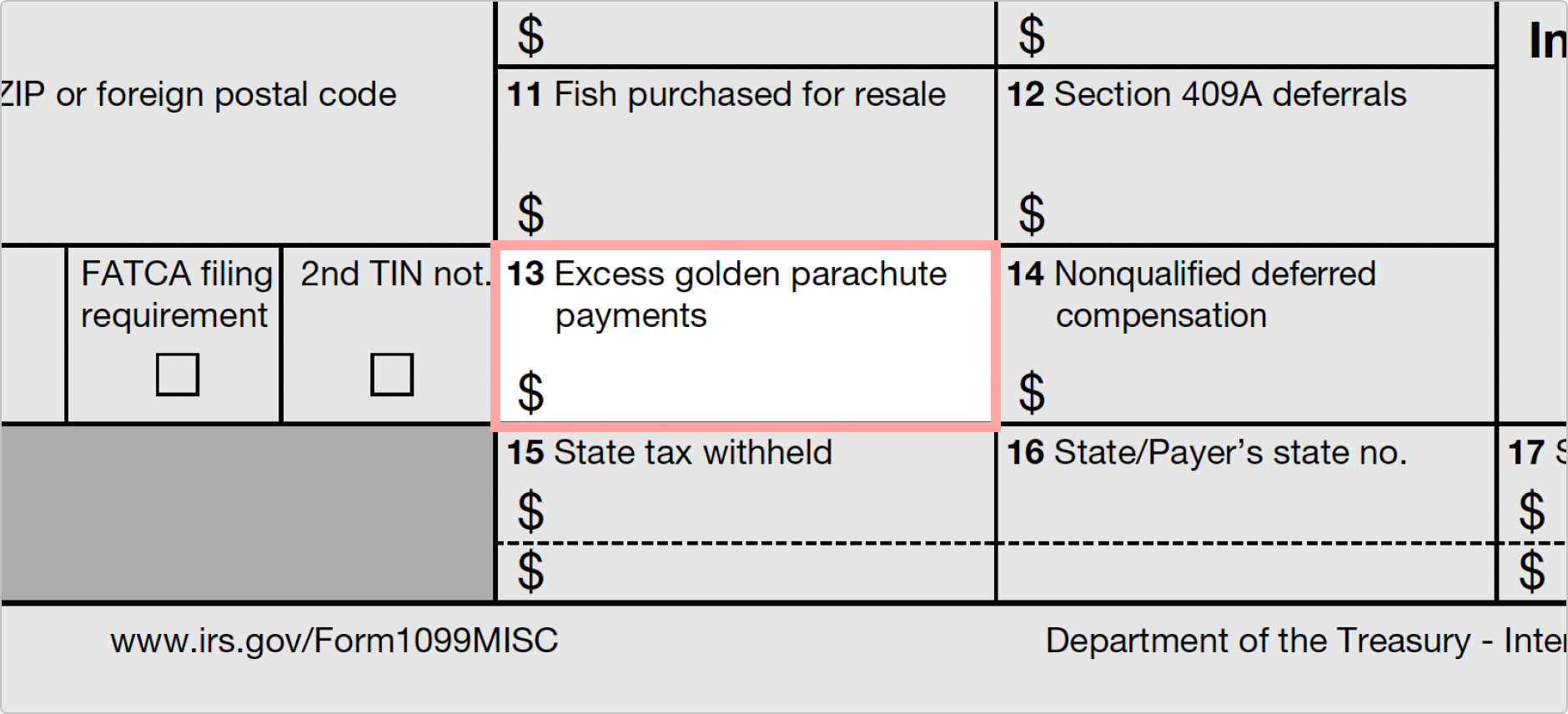

Box thirteen

Box thirteen is designated as Excess golden parachute payments. Excess golden parachute payments are reflected on Form 1040, and they are bailiwick to a 20% excise tax.

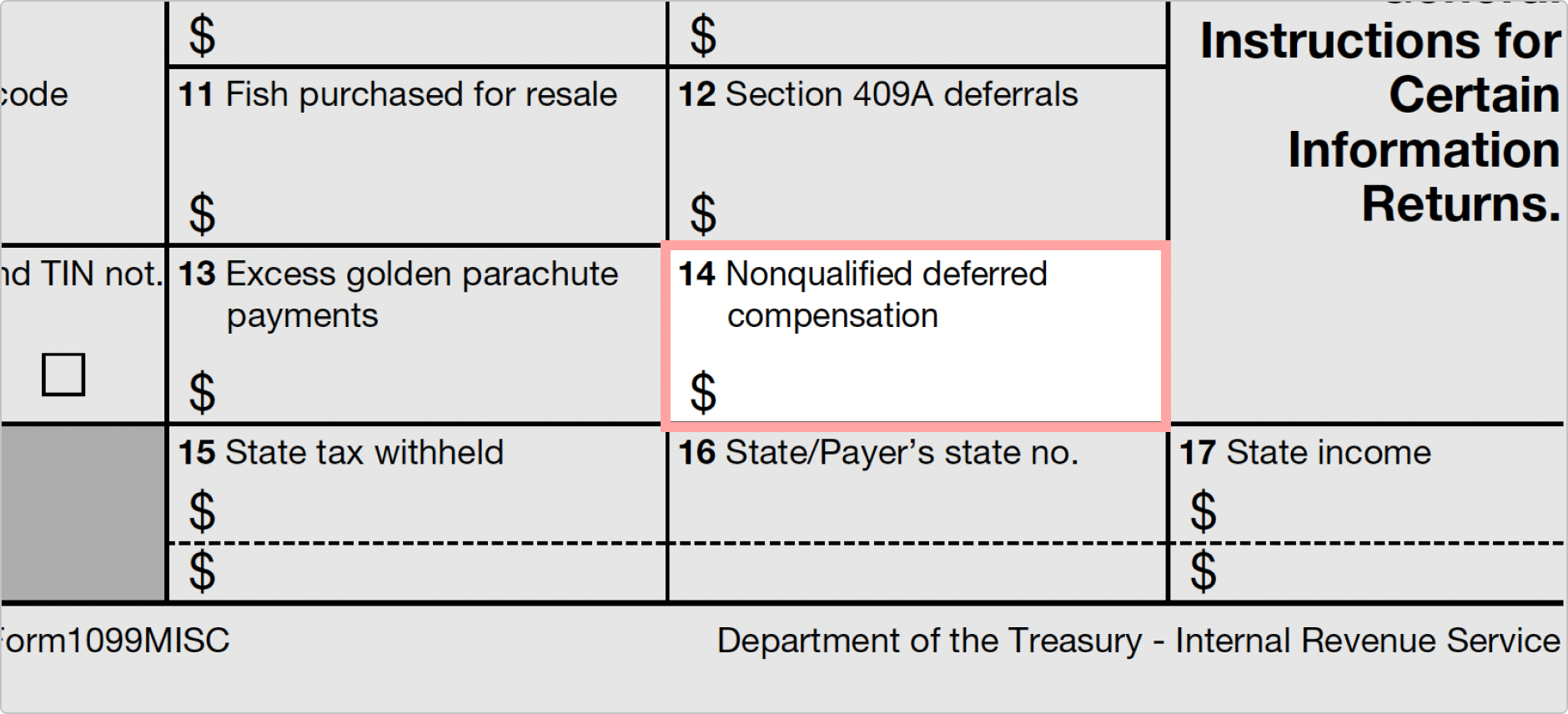

Box 14

Box 14 is designated for nonqualified deferred bounty.

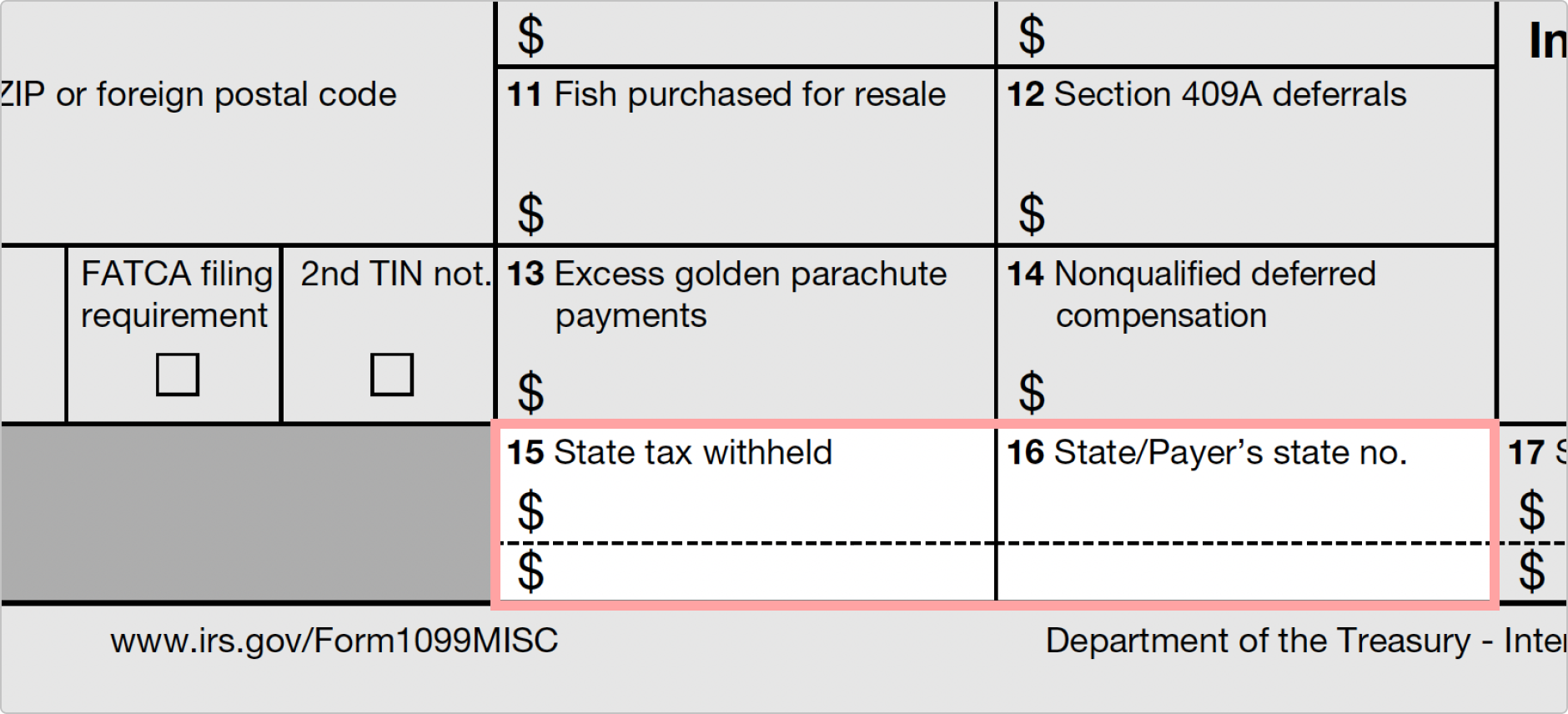

Boxes xv & 16

Box 15 holds information for state tax withheld. There is space for two states. Box xvi records the country or payer'due south state numbers. You will notice that at that place is enough room to list information for 2 states.

Box 17

Box 17 is used to record state income. Like the two previous boxes, at that place is enough room to list income for two states.

Boxes xv through 17 track state information, and they are only provided for the payer's convenience. They practise not demand to be filled by the payer. Payers who familiarize themselves with these boxes will discover that it isn't so complicated after all. Once completed, the payer must send a copy of information technology to the Internal Revenue Service and a copy to the paid individual.

How do you fill out a 1099-MISC?

This document should not be dislocated with a West-2 class or with the 1099-NEC. The 1099-NEC is used to pay freelancers and contained contractors. This is a recent change equally a 1099-MISC was previously used to record payments to freelancers and independent contractors.

Completing and filing this tax form is easy. Simply fill in the appropriate boxes co-ordinate to the definition of the boxes you learned about in this guide. Remember that you won't put data in every box. Once the form is complete, y'all'll send a copy to the person you paid, and you'll also send a copy to the IRS. The specific mailing address to send Re-create A (you'll learn more about the diverse copies and to whom they belong in just a moment) to the IRS may differ according to the payer's location. Information technology is advisable to refer to the Instructions for Form 1099-MISC. Information technology may be more convenient for you to file electronically. For you to practise that, you must have certain software that tin can generate a file according to the specifications found in Pub. 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, 8935, and W-2G.

1099 has several "copies." Here's the right way to distribute those:

Copy A must be sent to the IRS. You may also need to send Copy i to your land's tax department. Copy B must be sent to the recipient. Copy 2 may also need to be used by the recipient for their state taxes, so make sure you give that to them. Finally, there is Copy C. It is for you, the payer, to retain for your records.

Filing due dates for 1099-MISC forms take likewise been updated for the 2022 revenue enhancement year. The 1099-MISC must exist sent:

- To recipients by January 31, 2022

- To the IRS by February 28, 2022 if filing by post

- To the IRS by March 31, 2022 if e-filing

- The borderline for the 1099-MISC is unlike from the borderline for the 1099-NEC. The deadline for the 1099-NEC is January 31, 2022 for the 3 previously mentioned situations.

More resources

Source: https://formswift.com/1099-misc#:~:text=Those%20who%20need%20to%20send,boxes%20that%20must%20be%20completed.

Postar um comentário for "Where Can I Get 1099 Misc Forms for Free"